What Does the Inflation Reduction Act Mean for Homeowners?

What the Inflation Reduction Act Means for You: Tax Credits & Rebates in Virginia, DC & Maryland

Under the Inflation Reduction Act (IRA), significant investments were made to reduce the effects of U.S. carbon pollution. The act will benefit homeowners who make energy-efficient upgrades through tax credits and rebates on new HVAC, electrical, and plumbing equipment.

How much can homeowners save?

Tax Credits

With tax season upon us, everyone wants to save money and make the most of their taxes. This year’s IRA includes energy-saving changes and upgrades to homes, such as energy-efficient doors and windows, HVAC systems, heat pump water heaters, and solar panels.

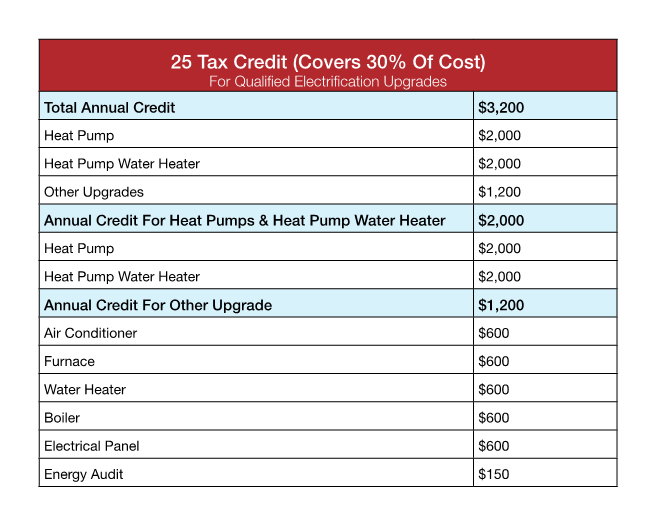

25C Energy-Efficient Home Improvement Tax Credit

Beginning January 1, 2023, the IRA will offer tax credits for households that make energy-efficient choices. At F.H. Furr Plumbing, Heating, Air Conditioning & Electrical, we can give you all the information you need about appliance options that qualify you for a tax credit and installation procedures when you’re ready to update.

The Energy Efficient Home Improvement Tax Credit is an expansion of the 25C tax credit that allows homeowners to deduct up to 30% of the cost of specific home improvements, up to $3,200 per year. Look at the chart below to see which energy-efficient appliances, upgrades, and devices qualify for a tax credit.

In addition to the equipment, installation and labor costs are included in the qualifying costs. Tax credits are not upfront savings. When you file your tax return, your tax credit amount is calculated based on these factors.

Certain requirements regarding installing new appliances or upgrading your home must be met to qualify for the tax credit. The F.H. Furr Plumbing, Heating, Air Conditioning & Electrical team can help you select tax credit-eligible qualified energy equipment that will help you save through tax credits and help save on overall annual utility bills.

Which Homeowners Are Eligible for Tax Credits?

All homeowners are eligible for the Energy Efficient Home Improvement Tax Credit. Tax credits are available for any new qualifying equipment you install or upgrades you make after Jan. 1, 2023.

The annual cap is $1200 per household (excluding heat pumps, which are capped at $2000), and there is a total cap of $3200. Now is the perfect time to improve your home and take advantage of these savings!

Call F.H. Furr Plumbing, Heating, Air Conditioning & Electrical at (703) 540-4838 for expert help and guidance on products and installation.

Claiming Your Owed Tax Credits

When you have completed the installation of your qualified energy property with F.H. Furr, you will receive documentation for your new, eligible energy-efficient upgrades.

Use the IRA savings estimation calculator to determine how much money you can save on your taxes through these credits.

Rebates Available Through the IRA

IRAs offer homeowners more than tax credits to help them reduce carbon pollution and inflation. Rebates will be available for upgraded appliances to make these changes even more affordable.

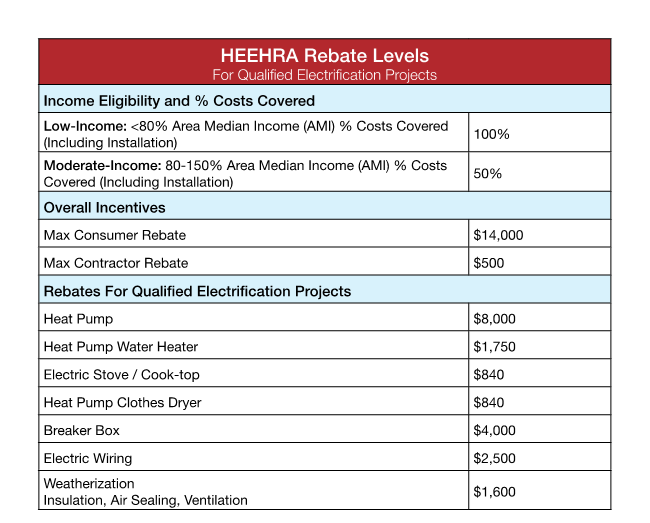

High-Efficiency Electric Home Rebate Act (HEEHRA)

Low- and moderate-income households can receive up to $14,000 in rebates per year on new, energy-efficient appliances and 100% coverage for electrification projects with the High-Efficiency Electric Home Rebate Act. Take a look at the chart below to see what kinds of rebates will be available:

Depending on your state, you can apply for most rebates for these appliances sometime in the second half of 2023. If you qualify for these rebates, contact F.H. Furr for advice on purchasing and installing any new appliances.

The HOMES Rebate Program

Homeowner Managing Energy Savings (HOMES) offers rebates for whole-home energy upgrades that reduce home energy consumption. These upgrades include installing energy-efficient appliances like heat pumps, better insulation, and other weatherization efforts.

As part of the HOMES program, households can receive rebates of up to $4000–$8000 if they decrease their energy usage by at least 35%. The more energy you save, the greater the rebate.

All households qualify for the HOMES rebate. The rebate is doubled for homeowners with low to moderate incomes and may cover up to 80% of project costs.

When will these rebates be available?

By the end of 2023, most of the rebates offered by the Inflation Reduction Act will be available. These rebates depend on your state of residence and Department of Energy guidelines.

Check with F.H. Furr by calling (703) 540-4838 to see if rebates are available when you’re ready to purchase.

A Cleaner Future for Us All

The purpose of the Inflation Reduction Act was to help Americans curb the expenses caused by the overuse of fossil fuels, reduce pollution, and develop cleaner energy resources. Americans can reduce their energy bills, save on taxes, and receive cash back by investing in and installing clean, efficient appliances and electrical upgrades.

The information is a lot to digest. If you have questions about how these types of appliances and upgrades work, the staff at F.H. Furr are happy to answer any questions.

Contact us online or call (703) 540-4838 for more information on taking advantage of the $369 billion Inflation Reduction Act.