Inflation Reduction Act Electrical & Plumbing Savings

How the Inflation Reduction Act Can Save Homeowners Money on Electrical & Plumbing Upgrades

The year 2023 is the perfect time to upgrade your home’s electrical and plumbing systems. You can make upgrades to reduce your carbon footprint and make your home more energy-efficient by taking advantage of the Inflation Reduction Act (IRA).

The Inflation Reduction Act will help homeowners make energy-efficient upgrades as well as reduce carbon pollution. The IRA provides generous tax credits, rebates on qualifying purchases, and long-term savings on utility bills.

How the IRA Can Save You Money on Plumbing & Electrical Home Improvements

You can save money on your energy bills in the long run by replacing old electrical systems or water heaters. With the Inflation Reduction Act, you can save more than $17,000 in tax credits and rebates each year.

Electrical Panel Updates

Electric panels (also called panelboards, subpanel boards, or breaker boxes) are connected to the main power supply of your home and distribute electricity to different parts of it. If they are working properly, these are easy to take for granted, but you can improve their energy efficiency and save money by upgrading them.

Your electrical panel probably needs to be upgraded if your home is more than 25 years old. Older homes may need to upgrade their panels to keep up with the growing number of power appliances in homes today. Although electrical work might seem daunting, it’s an important way to save money and energy and keep your family safe.

Call F.H. Furr Plumbing, Heating, Air Conditioning & Electrical at 703-690-0449 to get an expert assessment of the panel upgrades that are best for your home.

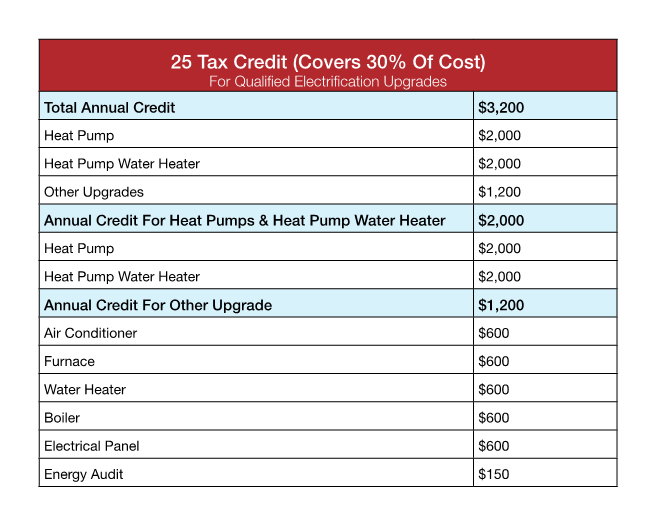

IRA Tax Credit for Electrical Panels

The IRA provides a tax credit of up to $600 for homeowners upgrading their electrical panels when combined with other qualified energy properties or upgrades covered by the Energy Efficient Home Improvement Tax Credit (25C). You’ll find more information on this credit below.

Water Heater Upgrades & Heat Pump Water Heaters

If your water heater is over 15 years old, it may be time to replace it. Besides older models breaking down, there are more efficient options, which will save you money and help you save water.

The size of your home and your typical water usage determine whether you should choose a fuel-powered or heat pump water heater. In traditional water heaters, propane, natural gas, or oil are used to heat water in tanks.

Instead of directing heat specifically to hot water, heat pump water heaters move heat between areas. The result is that your energy bill will be significantly reduced due to their energy efficiency. The plumbing pros at F.H. Furr will inspect your current water heater setup and recommend what will work best for you.

Inflation Reduction Act Tax Credit for Water Heaters

In addition to the $600 tax credit available for natural gas, oil, or propane water heaters, there is also a $2000 tax credit available for heat pumps.

Here’s a great savings calculator from Rewiring America that will show you how much you can save by making energy-efficient changes to your home.

Energy Efficiency Home Improvement Tax Credit (25C)

The Energy Efficiency Home Improvement Tax Credit of the IRA provides homeowners with specific tax credits — up to 30% — for home improvements. Using this credit, any energy-efficient plumbing or electrical improvements you make starting in 2023 can be claimed as a federal tax credit of up to 30% of the total cost, up to $3200 per year.

F.H. Furr Plumbing, Heating, Air Conditioning & Electrical can provide you with documentation on your new upgrades to claim these credits when you work with us for electrical and plumbing upgrades.

IRA Rebates for Electrical & Plumbing Upgrades

Also included in the IRA are rebates on energy-efficient electrical and plumbing appliances. These rebates will be available later in 2023.

HOMES Rebate

HOMES (Homeowner Managing Energy Savings) rebates are performance-based rebates that give you cash back based on how much energy you save through upgrades. For example, if you cut your energy use by 35%, you can save up to $8000, depending on where you live.

All homeowners qualify for the HOMES rebate, but low- and medium-income households can get more back. This program provides rebates based on the percentage of energy savings.

NOTE: The HOMES rebate cannot be combined with the HEEHRA rebates but can be combined with the Inflation Reduction Act tax credits.

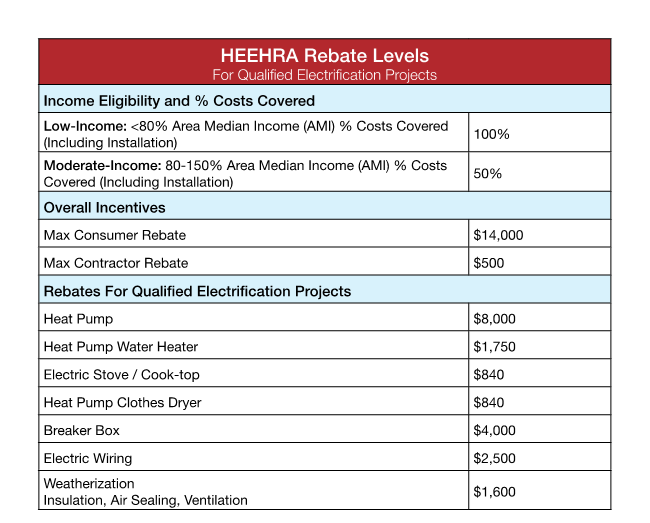

HEEHRA Rebate

For energy-efficient home improvement projects, the High-Efficiency Electric Home Rebate Act (HEEHRA) offers up to $14,000 in point-of-sale discounts (not tax deductions). These savings are applied at the point of purchase and are off-the-top discounts.

Up to $14,000 of qualifying costs may be covered by HEEHRA rebates, depending on your household income.

NOTE: You are allowed to claim HEEHRA rebates and tax credits.

Contact F.H. Furr today to see what kind of energy-saving — and money-saving — options are available for your household.

F.H. Furr Plumbing, Heating, Air Conditioning & Electrical has the electrical, plumbing, and IRA answers you need. Our experts are trusted in Virginia, Maryland, and DC and know the ins and out of the IRA rebates and incentives that will apply to your situation. We’ll ensure you receive the rebates you qualify for.

Whether you’re looking to make electrical upgrades, find a better water heater for your home, upgrade your electrical panel, or have questions about these kinds of projects, F.H. Furr can help you choose the right system for your home and work with you on what IRA tax credits and rebates apply.

Contact us today at 703-690-0449 to make an appointment or ask us questions about how you can take advantage of the Inflation Reduction Act.